A home’s overall condition, layout, color, and amenities matter most in a home appraisal. An appraiser will inspect the property inside and out, noting all the features that add value to the home, such as an updated kitchen, a large yard, or even a Jacuzzi tub. The appraiser will also research the neighborhood and compare the home’s value to other homes that have sold recently.

At a federal level, the Gramm-Leach-Bliley Act 1998 requires that all mortgage loan originators and their sponsors have the appropriate qualifications. In Connecticut, this means acquiring a license from the Department of Consumer Protection or completing courses in supervisor or provisional education.

While it isn’t required, you may also collect some information about the property to get an idea of your house’s initial cost. This can include the date of purchase, purchase price, date of the last sale, and sale price. It’s also good to keep a log of all your expenses, such as home maintenance, renovations, and improvements.

Keep in mind that the home’s value at the time of the purchase or sale might not be the same as its current market value. If you want to increase your home’s appraisal value, you’ll want to make sure that all of these factors are considered.

Size and layout are also two of the most critical factors in a home’s appraisal. A large, well-maintained home will typically be worth more than a smaller home in disrepair. Similarly, a home on a desirable street will typically be worth more than one on a less-desirable street. Finally, of course, color is just as crucial.

For example, in Connecticut, a home with exterior colors that are too bright may have a decreased overall value compared to their muted or toned down counterparts.

Do Appraisers Look at Cleanliness?

One of the most common mistakes homeowners make when trying to increase the appraisal value of their home is not taking into consideration all of the factors that go into it. However, appraisers don’t typically look at things like cleanliness when assessing a home’s value. Instead, the main factor they consider is the property’s condition.

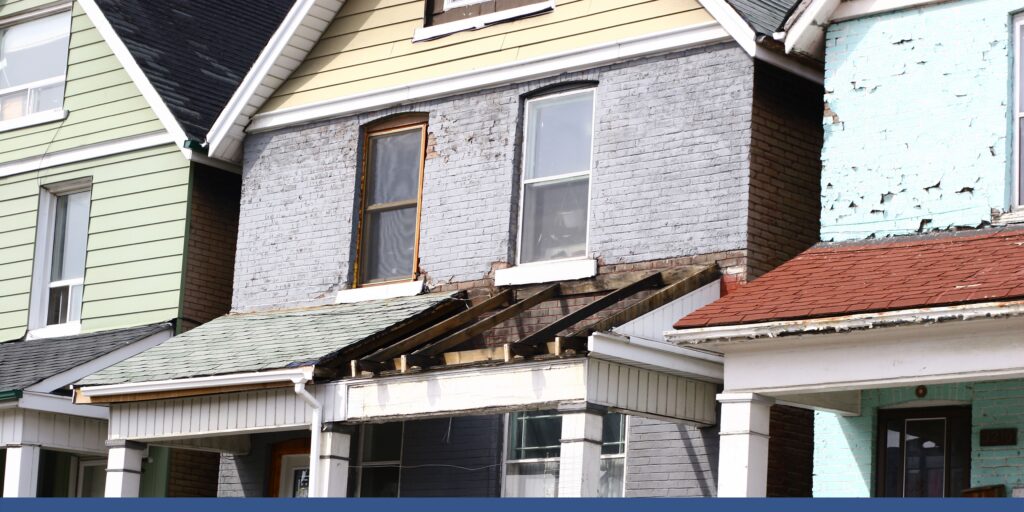

This includes pest infestation, deteriorating structure, potential hazards, and overall layout. Moreover, the exteriors such as the roofing condition, siding, foundation, gutters, chimneys, and overall external structure can also play a role in the home’s appraisal value. As long as your property is well maintained and has a desirable location, you can expect a healthy return when you sell it.

Do Appraisers Look at Gutters?

One of the ways you can increase the value of your home is by making sure it’s well-maintained. One way to do this is to make sure the gutters are clean and debris-free. Gutters are an essential part of your home’s drainage system, and if they’re not functioning correctly, water can build up and cause damage to your home. This can lead to increased repair costs and a decreased value for your property. If you’re looking for roofers in bethel ct to make your gutter clean, contact them now.

If you’re thinking about selling your home, it’s crucial to consider all of the factors that go into its appraisal value. Connecticut can have occasional moderate to severe weather conditions with tornadoes being more frequent recently. By keeping gutters clean and free of debris, you can ensure that your home gets a healthy appraisal value when it goes on the market.

Do Appraisers Look in the Garage?

Garages are often overlooked for home appraisals, but they can be a valuable asset. If your garage is well-maintained, it can increase the value of your home by attracting Connecticut buyers who are interested in fixing up or remodeling. Additionally, if your garage is large and has plenty of storage space, it could be used as an office or storage space.

If your garage is in good condition, you can expect to receive a healthy return on your home when you sell it. However, if your garage is in disrepair or doesn’t have enough storage space, it could lower the value of your home.

If you’re thinking about selling your home, make sure to consider all of the factors that go into its appraisal value. By looking at the condition of the garage and any potential additions or improvements that could be made, you can ensure a fair price for your property.

Do Appraisers Look at the Windows?

Windows can also be a valuable part of your home’s appraisal. If your windows are in good condition and let in plenty of natural light, they can increase the value of your home. Additionally, if your windows are newer and have a nice view, they can attract buyers looking for features that stand out.

If your windows are in good condition, you can expect to receive a healthy return on your home when you sell it. However, if your windows are in disrepair or don’t provide enough light and air circulation, they could lower the value of your home.

Do Appraisers Look at the Bedrooms?

Bedrooms can also be an essential part of your home’s appraisal. If the bedrooms have plenty of space and lovely views, they can attract Connecticut buyers who have big families looking for a comfortable place to sleep.

Bedrooms that look cramped and poorly lit could lower the value of your home. If you’re thinking about selling your home, consider all of the factors and any potential additions or improvements that go into its appraisal value to ensure a fair price for your property.

Do Appliances Affect Appraisal?

Appliances can also have a significant impact on the value of a home. For instance, energy-efficient appliances can save you money on your utility bills every month and add value to your home when you decide to sell.

There are plenty of high-quality energy-efficient appliances on the market today, and many of them come with extended warranties. However, unless they are vintage, your old, worn-out, and broken home appliances could lower the value of your home.

Does Paint Affect Appraisal?

Paint can also have a significant impact on the value of a home. For example, if your home has a lot of drywall or wallpaper, that can affect the appraisal value. So, if your home requires paint, make sure that you seek Custom Colonial Painting’s help for a professional house painting contractor’s expert advice to increase your home’s value.

Does Exterior Paint Affect Appraisal?

Yes, exterior paint can have a substantial impact on the value of a home. If your home has had a lousy paint job in the past, that could potentially decrease its value. Additionally, if your home has been recently painted and the paint is starting to wear off, that could lower the appraisal value. By looking at the paint condition and any potential additions or improvements that could be made, you can ensure a fair price for your property.

Can an Appraiser Lie?

In general, appraisers are not required to disclose all of the details about a home. This includes sensitive or confidential information about the previous owner or anything that could potentially lower the value of a home. However, dishonesty can quickly turn into appraisal fraud if they deliberately inflate the property’s value for insurance purposes or to receive a larger loan.

If this value is artificially inflated, you may make a bad loan which can lead to foreclosing the property, causing both financial and reputational harm. If you have any concerns about the appraisal of your home, it’s essential to speak with a qualified real estate agent who can help you investigate the situation.

What Should You Not Say to an Appraiser?

You should never lie to an appraiser or give them false information about your home. This could lead to inflated values and may even lead to fraud. Additionally, you should not provide the appraiser with confidential information about the property or the previous owner unless mandated or required.

This could seriously jeopardize the appraisal process. Additionally, do not try to influence the appraiser in any way. They are professionals who provide an accurate appraisal and do not curry favor with you.

Try not to demand so much from your appraiser or undermine their capabilities. Instead, be professional and provide them with all the necessary paperwork and information as early as possible to avoid last-minute stress.

Outline your expectations clearly and be respectful. If you are unhappy with the service you have received, you can always ask for a manager or representative.

What Decreases Home Appraisal?

There are a few things that can decrease the value of your home, which could lead to an inaccurate appraisal. The following are some of the most common reasons:

- Poor condition

If your home is in poor condition, this could lower the value significantly. This makes it difficult to sell and can also lead to costly repairs that your insurance may not cover.

- Lack of features

If your home does not have features that are popular among buyers, this could make it less desirable to them. Since this trend usually changes fast, research what features are most popular among buyers and ensure that your home has these before it fades away. This does not necessarily mean installing a pool or getting a view; it could be as simple as repainting the walls to a specific color or putting in new flooring.

- Negative equity

If you owe more on your home than it is worth, this will decrease its value. This could be due to various factors, such as high-interest rates or declining property values.

- Location

If your home is in a less desirable location, this could potentially decrease its value. However, if you live in an area where property values are increasing, it might make sense to hold onto your home as long as possible, as this can be beneficial in the long run.

What to Do if Appraisal Comes in High?

If you receive an appraisal that is significantly higher than the market value of your home, you’re probably in good hands. However, if you get lower, you can still do a few things to improve it.

First, you can contact the appraiser and provide documentation of recent sales in your neighborhood to show that your home is significantly undervalued.

Additionally, you can try to get a second opinion from a different appraiser. Another option is to have a home inspection done. This will help you identify any problems with the home that may not have been apparent before the initial home visit.

Additionally, you can try to negotiate a higher appraisal value with your agent or the appraiser. If these efforts do not increase the initial appraisal value, you may have to consider selling at a below-market rate.

What Will Fail a Home Appraisal?

A home appraisal will not be valid if it is based on an incorrect or outdated property assessment or has any major physical or structural problems. If there are issues with the home that is likely to cause significant problems or reduce the home’s value, then the appraiser must note this in the appraisal.

An appraiser can only provide a valid appraisal if they have inspected the property thoroughly and have access to all the relevant information. They must also be honest and unbiased when conducting an appraisal. If the appraiser has a personal connection with the person selling or buying the property, they must disclose it to avoid conflicts of interest later on.

Increase your chance of getting a good appraisal score by improving your home’s structure and aesthetic. Call Custom Colonial Painting in Connecticut now for free estimates!